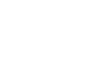

Tensions between the United States and China have intensified once again after Beijing announced new restrictions on the export of rare earth minerals—materials crucial to modern technologies, electric vehicles, and defense systems. In response, former U.S. President Donald Trump issued a strong warning of potential retaliation, signaling the start of another heated phase in the ongoing economic and geopolitical rivalry between the world’s two largest economies.

Rare earth minerals may sound obscure, but they play an essential role in everything from smartphones and wind turbines to fighter jets and satellites. With China controlling a vast majority of the world’s rare earth supply, its decision to limit exports could have global repercussions.

This article explores what rare earths are, why China’s restrictions matter, and how Trump’s call for retaliation could shape the next chapter of U.S.–China relations.

Understanding Rare Earth Minerals

Rare earth minerals are a group of 17 metallic elements that are critical to many modern technologies. They are used in electric motors, semiconductors, medical equipment, and renewable energy systems. Despite their name, these elements are not rare in nature but are difficult and costly to extract and process.

China currently dominates the rare earth market, producing over 70 percent of the world’s supply. This dominance gives Beijing a powerful tool in trade negotiations, especially with nations that rely heavily on high-tech manufacturing, such as the United States, Japan, and South Korea.

For years, U.S. policymakers have expressed concern about this dependency, warning that any disruption in rare earth supplies could impact the national economy and defense sector.

China’s Decision to Restrict Exports

In a recent announcement, China revealed new restrictions on rare earth exports, citing national security and environmental protection reasons. The move will require exporters to obtain additional licenses and approvals before shipping key minerals abroad.

While Chinese officials have described the policy as a routine measure, analysts view it as a strategic response to rising tensions with the United States over trade, technology, and geopolitical competition.

The timing is significant—coming just as the U.S. has tightened controls on advanced semiconductor exports to China. This tit-for-tat pattern has become a defining feature of the modern trade war between the two nations.

Trump’s Reaction and Warning of Retaliation

Former President Donald Trump, known for his tough stance on China, reacted swiftly to the news. He accused Beijing of using trade as a weapon and warned that the United States would retaliate with measures designed to protect American industries and technology.

In a statement, Trump emphasized that “the U.S. will not allow China to hold the world hostage through its control of critical materials.” He hinted at new tariffs, restrictions on Chinese companies, and incentives for domestic mining projects as possible responses.

His remarks echoed the rhetoric of his presidency, when trade conflicts with China dominated global headlines and reshaped international markets.

The Broader Trade War Context

The latest confrontation over rare earths is part of a much larger and ongoing trade war between the United States and China. The two countries have clashed over intellectual property, technology transfers, tariffs, and control over key supply chains.

Under both Trump’s and Biden’s administrations, Washington has sought to reduce reliance on Chinese manufacturing and secure domestic sources for essential materials. Meanwhile, Beijing has aimed to assert its technological independence and defend its export-driven economy.

The result has been a complex mix of tariffs, sanctions, and political maneuvering that has affected everything from agriculture to advanced electronics. The rare earth issue adds another layer of tension to an already strained relationship.

Why Rare Earths Matter to the U.S. Economy

The importance of rare earths cannot be overstated. These elements are crucial to industries that form the backbone of the American economy and military strength.

In the defense sector, rare earths are used in missile guidance systems, jet engines, and communication technologies. In civilian industries, they are essential for producing smartphones, laptops, electric vehicles, and renewable energy infrastructure.

A sudden shortage or price surge caused by Chinese export restrictions could disrupt production, raise costs, and slow innovation across multiple sectors. This vulnerability has prompted U.S. leaders to explore alternative sources and invest in domestic mining capabilities.

Potential U.S. Responses

In light of China’s restrictions, several possible U.S. responses are under discussion. Trump’s comments suggest that retaliation could take the form of tariffs or trade barriers on Chinese goods. However, experts believe the U.S. may also take a more strategic approach by:

-

Boosting domestic mining and refining: Encouraging rare earth mining projects in states such as California and Texas.

-

Investing in recycling technologies: Recovering rare earths from old electronics to reduce dependency on imports.

-

Strengthening alliances: Partnering with countries like Australia and Canada, which also have significant rare earth reserves.

-

Building stockpiles: Creating national reserves of critical minerals for use in emergencies.

These measures could take time to implement, but they reflect growing recognition of how critical rare earth independence has become to national security.

Global Reactions and Market Impact

China’s decision and Trump’s response have already rattled global markets. Prices for several rare earth elements surged as traders anticipated supply shortages.

Manufacturers dependent on these materials—especially in the electronics and electric vehicle industries—are assessing the potential cost increases. Meanwhile, alternative suppliers such as Australia’s Lynas Rare Earths have seen rising investor interest.

Other nations are watching closely. Japan and South Korea, both heavily reliant on Chinese rare earths, may seek closer cooperation with Western allies to secure their own supply chains.

Environmental and Ethical Concerns

One reason China maintains dominance in rare earth production is the environmental cost of mining. The extraction process generates toxic waste and can harm local ecosystems.

In contrast, many Western countries have stricter environmental standards that make rare earth mining expensive and politically sensitive. However, the growing geopolitical risks are now pushing governments to reconsider these trade-offs.

The U.S. may soon face the challenge of balancing environmental concerns with the urgent need for resource independence—a complex dilemma in an era of climate-conscious policymaking.

The Technology and Defense Connection

Rare earths are not just about economics—they are about power. These elements form the foundation of technologies that drive military innovation, artificial intelligence, and clean energy.

In recent years, both China and the United States have recognized that technological dominance translates directly into geopolitical influence. By restricting exports, China sends a clear message: it has leverage in the global competition for advanced technology.

Trump’s warning of retaliation reflects recognition of that leverage—and a determination not to let the U.S. fall behind.

Historical Context of Rare Earth Disputes

This is not the first time China has used rare earths as a strategic tool. In 2010, Beijing temporarily halted exports to Japan during a diplomatic dispute, causing prices to spike worldwide.

That event prompted several countries to begin exploring alternatives, but progress has been slow. Over a decade later, the world remains heavily dependent on China’s production capacity, despite repeated warnings about the risks.

The latest restrictions could finally push nations to act decisively, accelerating investment in mining, innovation, and recycling.

The Economic Stakes

The rare earth issue has implications far beyond the mining industry. It affects trade balances, stock markets, and even job creation. A prolonged trade confrontation could disrupt global supply chains at a time when the world economy is already grappling with inflation and post-pandemic instability.

If China limits exports for an extended period, prices for high-tech products could rise worldwide. Electric vehicle manufacturers, renewable energy companies, and defense contractors would all feel the impact.

At the same time, any U.S. retaliation through tariffs or sanctions could further strain economic ties, affecting sectors from agriculture to finance.

Trump’s Political Influence on the Debate

Even though he is no longer in office, Donald Trump’s words carry significant weight in American politics and international affairs. His call for retaliation has reignited debate within the U.S. about how to handle China’s growing power.

Supporters of Trump argue that his tough approach is necessary to defend American interests and reduce dependence on foreign materials. Critics, however, warn that escalating tensions could backfire, leading to higher prices and deeper divisions.

Regardless of political alignment, few disagree that the rare earth issue highlights a fundamental vulnerability that must be addressed.

The Path Toward Rare Earth Independence

In recent years, the U.S. government has taken steps to reduce reliance on Chinese rare earths. The Department of Defense has funded research into alternative supply chains, while private companies have invested in domestic production.

Projects such as the Mountain Pass mine in California are key components of this strategy, though experts note that it will take years before the U.S. can meet its own demand.

The challenge is not only extracting the minerals but also refining them—a process that China has mastered and others have struggled to replicate efficiently.

The Global Shift Toward Resource Security

As nations recognize the strategic importance of critical materials, a broader shift is underway. Resource security has become as vital as energy security once was.

Countries are diversifying suppliers, forming partnerships, and building stockpiles to avoid dependence on any single source. The European Union, for instance, has launched its own critical minerals strategy, emphasizing sustainable sourcing and recycling.

The U.S.–China dispute may accelerate this trend, leading to a more decentralized global supply network—but also to increased competition and environmental pressures.

Frequently Asked Questions

What are rare earth minerals?

Rare earth minerals are 17 metallic elements essential for producing technologies such as smartphones, electric vehicles, wind turbines, and defense equipment.

Why did China restrict rare earth exports?

China cited national security and environmental concerns, though analysts believe the move is a strategic response to U.S. trade and technology restrictions.

How much of the world’s rare earth supply does China control?

China currently produces more than 70 percent of the world’s rare earth supply, giving it significant leverage in global markets.

Why is the U.S. concerned about this restriction?

The United States relies heavily on rare earth imports for critical industries, including defense and technology. Restrictions could disrupt supply chains and raise costs.

How did Donald Trump respond?

Trump warned that the U.S. would retaliate against China’s restrictions, suggesting new tariffs, sanctions, and efforts to boost domestic rare earth production.

Can the U.S. produce its own rare earths?

Yes, but production and refining capacity are limited. Developing a self-sufficient supply chain could take several years and major investment.

What impact could this have on global markets?

The restrictions could increase the cost of high-tech goods, disrupt supply chains, and intensify competition for rare earth resources worldwide.

Conclusion

The clash over rare earth exports marks another turning point in the ongoing power struggle between the United States and China. By restricting exports, Beijing has reminded the world of its dominance in critical materials, while Donald Trump’s warning of retaliation underscores the urgency for America to secure its own supply chains.

What happens next will depend on diplomacy, innovation, and political will. The world is watching closely as two superpowers test each other’s resolve in a conflict that extends far beyond trade—it touches the very core of technological and economic leadership in the 21st century.

The rare earth issue is more than a dispute over minerals; it is a battle over the future of global influence, national security, and industrial independence. Both nations now face a defining question: can they compete without compromising the stability of the world economy?